What is Per Diem?

Per Diem translates into “daily” or “for each day” from Latin. Therefore, it’s a payment based on a day’s time. This is different then your day rate which is usually for a set number of hours and should include overtime when exceeding those predetermined hours. For the entertainment technician Per Diem refers to an amount of money that you may receive for expenses to cover your expenses while you are away from your home city. There are various ways that production companies approach per diem. The more reputable ones will pay you the amount outlined by the federal government for any given city or state.

What does Per Diem cover?

Per Diem is meant to cover all of your expenses while you are out of town for events that require you to stay locally at a hotel, etc. Commonly this means your hotel and your meal expenses. Since a majority of production companies will usually pay for the hotel at the client’s expense, your Per Diem is most often designated for your dining needs.

Legally your Per Diem is allowed to cover your lodging, meals, and possibly your incidental expenses (laundry) while on-site. Each one of these is regulated by schedules published by the federal government.

How much will I receive in Per Diem?

How much you will receive daily depends on multiple factors including what city you will be in and for which month. Some production companies may not follow the government schedule and that may be something you’ll need to negotiate directly.

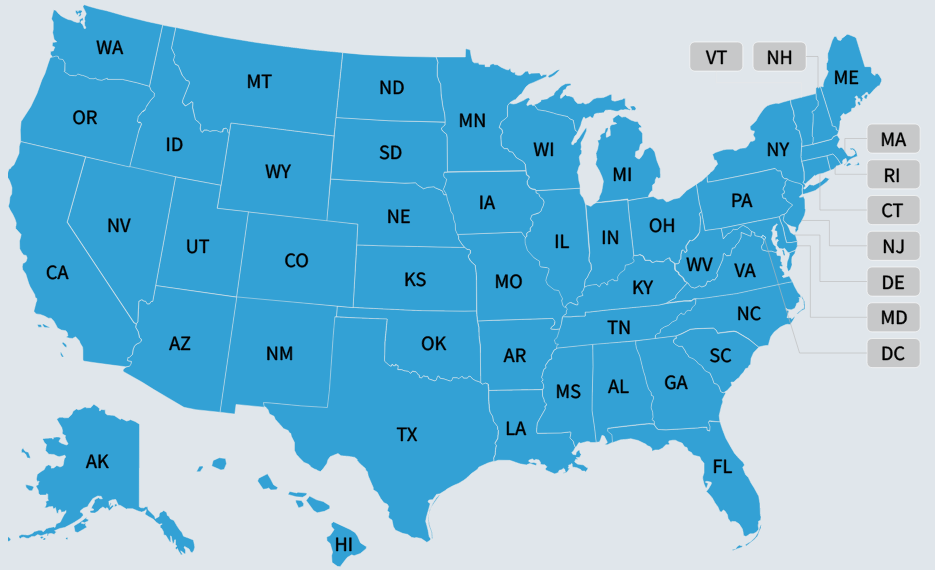

Clicking on the image below will take you to the official US Gen. Services Administration page.

Here is an example of Pennsylvania. They list a standard rate for localities that don’t have specific rates. You’ll see below that lists Allentown and nearby Easton and Bethlehem have slightly higher rates.

| Standard Rate | Applies for all locations without specified rates |

| M&IE Total $55Continental Breakfast/Breakfast $13Lunch $14Dinner $23Incidental Expenses $5First & Last Day of Travel $41.25 |

|

| Allentown / Easton / Bethlehem | Lehigh / Northampton |

| M&IE Total $61Continental Breakfast/Breakfast $14Lunch $16Dinner $26Incidental Expenses $5First & Last Day of Travel $45.75 |

What if I spend more than the given rates above?

Personally, one of my favorite things about working events away from home is enjoying a meal based on what’s available in the local area. I try to find a really good restaurant for at least one meal. Quite often, the check exceeds my allotted per diem for the day. Unfortunately, that’s on me. However, these meals are often had with fellow members of the crew and if we discussed business that extra cost can be deducted as a business expense. Meticulous record keeping is required should you wish to go down that route. Sometimes it’s simply not worth that effort.

What if I spend less than the given rates above?

According to the tax code set by the GSA and IRS, Per Diem is supposed to be spent solely on meals and expenses while you are out of town. Employees are supposed to submit an expense report and receipts to show where there per diem money went. Some companies request this, and some companies don’t bother. As a self-employed independent contractor you are your own employee and therefore you should be tracking your expenses and reporting it to yourself.

The official legalese answer to this question is: you should refer to your tax professional for specific advice on this.

Employees who dine at a lower cost are able to keep the additional funds without any tax implications, and employers rarely ask for any funds not used to be returned. (zenefits.com)

What are the Taxes regarding per diem reimbursements?

Though I have not seen a production company ask for this information as they are hiring freelancers as independent contractors, the tax code says that W2 employees should be prepared to submit the following report, which includes:

Details of the trip including dates and times.

The overall business purpose of the trip.

Receipts for lodging if you paid for it. If you pay out-of-pocket and they reimburse you, you’re going to need the receipt anyway..

Receipts for your dining expenses.

Therefore, regardless of your circumstances it is advisable to keep any and all receipts and make notes about what you’re doing, who you’re with, and especially the fact that you discussed business during each and every meal. The simple fact that we spend so many of our meals with fellow crew members makes this last part extremely easy. Did you forget a receipt? The site comes in handy https://expressexpense.com/receipt-maker.php

Is Per Diem Considered Income?

No. Per Diem is not considered income and is not taxable. Therefore, it also should never be included on your miscellaneous 1099s form. Another reason to keep your book straight is to double check this at the end of the year. If they send you a 1099 form and it seems like they’ve piled on the Per Diem, you must contact the production company and have them correct the 1099 form. If they don’t, you will end up paying income tax on that money. Some will say the you can simply deducted off your taxes as expenses but that takes us back to the need to keep careful receipts. Additionally, if you did not discuss business during those meals, they may not end up being fully deductible.

How do I receive my Per Diem or how will Per Diem by paid?

This varies by production company. Some may hand you actual cash. Some will issue a check either before you depart so you have spending money during your time with them. Most will issue a check when they pay you. This is something you should find out and agree upon when accepting the assignment.

Depending on how you handle your invoicing and/or receiving a purchase order from the production company you work with, your Per Diem will likely be a line item unto itself. See our pages on invoices and/or purchase orders for more on this.